On July 28th, Realtor.com published an article by Clare Trapasso (link) with surprising statistics about a surge in homeownership during the 2nd quarter of this year.

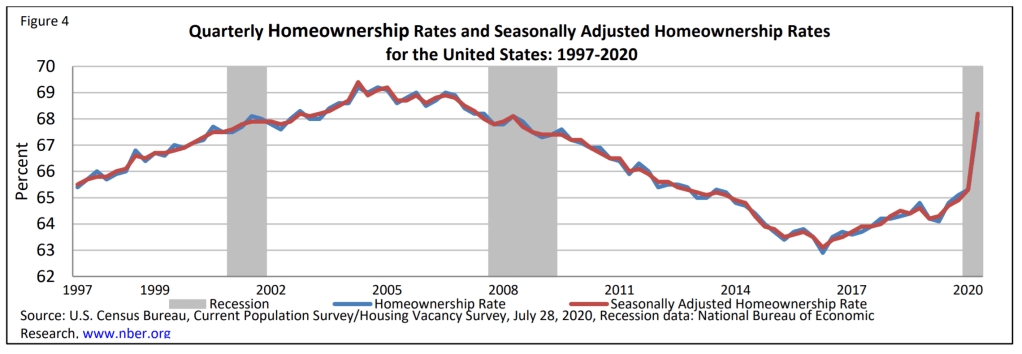

According to her article, which was based on a U.S. Census Bureau report (link), the homeownership rate surged to 67.9%, the highest it has been since the Great Recession of 2008. (See chart below.) That rate was 3.8 percentage points higher than the same quarter of 2019 and 2.6 percentage points over the first quarter of this year. Covid-19 arose during the last month of the first quarter, but it dominated the entire second quarter.

The homeownership rate in this century peaked at 69.2% during the second and fourth quarters of 2004.

As you’d expect, the homeownership rate varies among different age groups, currently 40.6% for adults under 35 and 80.4% of persons 65 and older. The rate has been rising in each age group. In 2015 (2nd quarter) it was 38.4% for the under-35 age group, and it was 78.5% for the 65-and-over group. The greatest increase was in the 35-44 age group, which increased from 58.0% to 64.3% during the same 5-year period.

Homeownership surged in every race and ethnic group in the second quarter from last year to this year. For Non-Hispanic Whites, the rate increased from 73.1% to 76.0%. For Blacks it surged from 40.6% to 47.0%, and for Hispanics of any race, it surged from 46.6% to 51.4%.

The Census report came with a caveat that its data collection methodology was impacted by the Covid-19 pandemic, shifting from a mix of in-person and phone interviews to entirely phone interviews, which resulted in a reduced response rate, declining from 70% in April to only 65% in June, compared to an average response rate of 82.7% during the second quarter of 2019.

Realtor.com’s chief economist, Danielle Hale, believes the increase in homeownership was distorted by the change in methodology. “It’s likely the homeownership rate rose, but I don’t think it’s likely that it rose that much,” she said.

According to the article on realtor.com, “After a pause during stay-at-home orders, the housing market has rebounded — and then some. The lack of homes on the market hasn’t discouraged the hordes of buyers from descending en masse, seeking to escape small, city apartments and cramped starter homes while taking advantage of record-low mortgage interest rates. (Rates dipped just below 3% for the first time ever earlier this month.)”

As an example, Rita and I just locked in an interest rate of 2.5% for refinancing our home’s mortgage with Jaxzann Riggs of The Mortgage Network. A buyer I’m working with was quoted a 2.25% rate.

“People still want to own homes, and with mortgage rates low, a lot of people are taking advantage of that even though there are lots of scary things going on in the economy,” says realtor.com’s Hale.

The article continues, “This has led median home prices to shoot up 9.1% year over year in the week ending July 18. That’s despite a recession and the most widespread unemployment since the Great Depression. Meanwhile, the number of homes for sale is down 33% compared with the previous year, when the nation was already experiencing a housing shortage.”