If you’re not already getting my weekly column there, go to http://realestatetoday.substack.com and subscribe. See you there!

If you’re not already getting my weekly column there, go to http://realestatetoday.substack.com and subscribe. See you there!

I have written often about geothermal heating and cooling. To remind you, by drilling either horizontally or vertically beneath your house or yard, you can use the 50-degree warmth of the earth, combined with a heat pump, to heat your home in the winter and cool it in the summer with minimal electrical energy to run a heat pump compressor.

The most common geothermal system involves several wells that are 300 feet deep, through which water or glycol is circulated to bring 50-degree liquid to a heat pump where it is heated to over 100 degrees in the winter or cooled to, say, 40 degree in the summer. Alternatively, you can install a horizontal loop over a wide area 10 feet below the surface and still get that 50-degree liquid for your heat pump to work with.

That’s called a “ground-source” heat pump system. More common (because it’s less expensive) is an “air-source” heat pump system, which warms or cools the outside air, extracting heat from outside air that can be as cold as zero degrees Fahrenheit. In the summer, the heat pump reverses its function and extracts heat from your indoor air, thereby cooling your home. The heating cycle requires more electrical energy for the air-source heat pump, especially when it’s really cold outside.

So geothermal is definitely the “gold standard” of household heating, but I’ve only seen it in a few homes because of its cost. I’ve visited homes in South Golden, Applewood and Centennial, plus single-family homes in the Geos Community in Arvada, that have geothermal heat pump systems.

Until I heard about ground-source heat pumps, the word “geothermal” brought to mind places like Iceland where volcanic rock is so close to the surface that you could heat your home without the additional input of a heat pump. (Cooling is another matter, of course.)

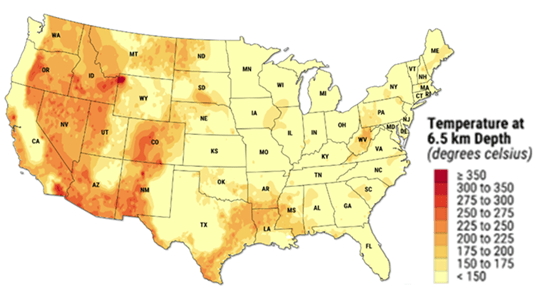

In Iceland, geothermal is used to create electricity from the steam created by that near-surface heat. I had assumed that running a power plant without such near-surface molten rock was impractical until I read an August 28th article in The New York Times which made me aware of progress being made using geothermal resources six miles or deeper underground to run power plants. The map below shows the temperature at 6.5 kilometers depth (~4 miles deep) in Centigrade, where 100º is the boiling point of water. According to the article , there is enough heat that deep to provide five times the total energy needs of our country — if it can be tapped. (That’s reminiscent of the claim that one hour of mid-day summer sun produces as much energy as the country’s entire electrical demand — if it can be tapped.)

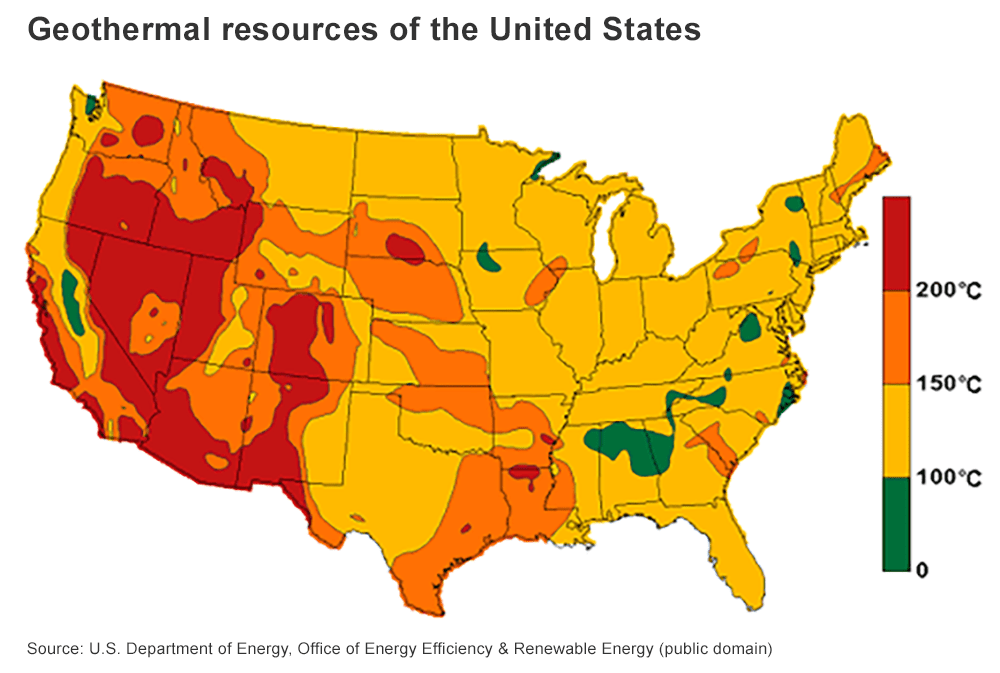

Here’s another view:

Ironically, the tech breakthroughs of the oil and gas industry, especially fracking, are making it more practical to tap that geothermal energy. As Brad Plumer of the Times writes in his article, “by using advanced drilling techniques developed by the oil and gas industry, some experts think it’s possible to tap that larger store of heat and create geothermal energy almost anywhere.”

The U.S. Department of Energy, under which Jeffco’s National Renewable Energy Laboratory (NREL) operates, has created a Geothermal Technologies Office to advance what it has trademarked as the Enhanced Geothermal Shot™. (Here’s a link for their website. There’s a really effective minute-and-a-half video on that website explaining “Enhanced Geothermal Systems.”)

Plumer writes, “Dozens of geothermal companies have emerged with ideas. Fervo is using fracking techniques — similar to those used for oil and gas — to crack open dry, hot rock and inject water into the fractures, creating artificial geothermal reservoirs. Eavor, a Canadian start-up, is building large underground radiators with drilling methods pioneered in Alberta’s oil sands… The growing interest in geothermal is driven by the fact that the United States has gotten extraordinarily good at drilling since the 2000s. Innovations like horizontal drilling and magnetic sensing have pushed oil and gas production to record highs, much to the dismay of environmentalists. But these innovations can be adapted for geothermal, where drilling can make up half the cost of projects.”

What excites me about this effort is that because it utilizes the same drilling and fracking methodologies, to reach the hot rocks, it’s a more attractive transition for the oil and gas workforce, compared to training the workers to service wind turbines or install solar panels.

Sixty percent of Fervo’s employees, according to Plumer’s article, came from oil and gas, and oil companies and drilling-service companies are investing in the startups which are pioneering geothermal energy drilling in Utah and elsewhere. “Devon Energy invested $10 million into Fervo, while BP and Chevron are backing Eavor. Nabors, a drilling-service provider, has invested in GA Drilling, Quaise and Sage. In Oklahoma, a consortium of oil and gas firms led by Baker Hughes recently launched an effort to explore converting abandoned wells into geothermal plants.”

The “roadmap” created by the Energy Department’s Geothermal Technologies Office breaks down as follows:

I included that hard-to-read list only to reinforce what I said above, namely that this is the kind of work that’s a natural fit for the oil and gas industry. Instead of drilling for oil, they’re drilling for heat.

By the way, there are already 11 geothermal power plants operating along California’s Salton Sea.

This private, secluded townhome at 1120 10th Street #G in downtown Golden was just listed by Jim Swanson. The Tenth Street Row Home community has no HOA dues and minimal covenants. Walk one block to Clear Creek, Lions Park, tennis courts and baseball fields. The Golden Public Library is just a block further, and Washington Avenue, with its shops, restaurants and more, is just 4 blocks away! The Golden Rec Center is just 3 blocks in the other direction! The seller-owned solar system fully meets this townhome’s electrical demand and is included in the sale. This home has updated bathrooms, a large living room/dining room area, and bigger than average bedrooms. The primary suite has a private covered deck (visible in the above picture). The home has hot water baseboard heat and is cooled with a newer evaporative cooler. Partly visible above is the fenced 20’x20’ porch and garden area. This is a rare opportunity to live close to everything that makes Golden a great place to live. Take a video tour (with drone footage) below or at www.GoldenTownhome.info. The seller requested no open houses, so call your agent or listing agent Jim Swanson at 303-929-2727 to see it in person.

As you may know, Rita and I sold Golden Real Estate’s former office building on South Golden Road at the end of July. However, part of the contract of sale was that the buyers, Joe & Stacy Fowler of the Golden Hayride, would lease back to us a parking space for our free moving truck and the box shed which holds the free moving boxes we provide to clients.

The new location for the truck and shed is at the northwest corner of their parking lot at 17695 S. Golden Road. Here’s a picture:

We are super impressed with the changes which Joe & Stacy are making to the building and lot. Consistent with their Old West hayride motif, they have completely redone the inside, including installing wood laminate flooring and wood paneling that looks terrific!

Golden Hayride is a familiar site to Golden residents. Below is a picture of them and their truck, which is available for special events. You can catch one of their Beer Tours on their website, www.GoldenHayride.com. Here’s what’s on their calendar: Friday, September 29, Saturday, October 7, Saturday, October 14, Friday, October 20, Saturday, October 21, Saturday, October 28, Saturday, November 4, and Saturday, November 11.

Golden Real Estate has a box truck which we lend free to our clients for moving to or from the homes we sell for them. We also provide free moving boxes and packing materials which we keep in a shed at 17695 S. Golden Road, where the truck is still parked, although we recently sold the building.

We negotiated a 5-year rent-back of a parking space for the truck and the box shed and agreed to move the truck and shed to the far end of the parking lot.

Moving the box shed required hiring Cory of Shed Runners, who has a remote-controlled, purpose-built trailer built specifically for moving sheds much larger than ours. I made a short video (2:40) documenting the move, which you may find interesting. It wasn’t how I expected the shed to be moved.

Here’s the YouTube video:

Golden Real Estate is a Realtor brokerage, meaning that all our agents belong to a local Realtor association and thereby are members of the Colorado Association of Realtors and the National Association of Realtors.

“Realtor” is a trademark, and only members of a Realtor association can call themselves Realtors. That’s also why Realtor, like Kleenex, should always be capitalized.

It’s estimated that only half of all licensed real estate agents are Realtors, but you have to be a Realtor if you want to work for us or any other Realtor brokerage. All the major franchises are Realtor brokerages, but there are lots of non-Realtor brokerages that an agent can join if he or she wants to avoid the $500+ annual dues to be a Realtor.

So what’s in it for an agent to be a Realtor, paying over $5,000 per decade for the privilege?

First of all, non-Realtors can’t work for a Realtor brokerage such as ours. They’d have to be independent or join a non-Realtor brokerage. Some brokerages, such as HomeSmart, Your Castle, and Resident Realty, have created both Realtor and non-Realtor brokerages with near-identical or identical logos and near identical names so that the average client or prospective client would have no idea that the agent they are speaking with might not be a Realtor.

I feel that’s deceptive advertising, which violates the Realtor Code of Ethics, but non-Realtors aren’t bound by that code. There are benefits to being a NAR member that wouldn’t mean much to consumers. More than that, however, I believe in “paying one’s dues.” All agents benefit from NAR’s lobbying on our behalf and for property rights in general, but only Realtors pay for it. Non-Realtors benefit from that lobbying but are, in effect, getting a free ride.

There’s a growing movement, with good reasons, to eliminate natural gas from our homes. Think carbon monoxide poisoning. Or the bad health effects of inhaling methane. Or home explosions from gas leaks. Or how the use of natural gas (which is methane) contributes to greenhouse gas emissions, exacerbating climate change.

While it’s easy (and financially incentivized by state, federal and utility re-bates) to replace your gas furnace with a ducted or ductless heat pump system and your gas-fired water heater with a heat-pump water heater, many homeowners — myself included when I owned a single-family home — find it hard to accept giving up their gas fireplaces and gas grills.

Rita and I had to give up our gas grill when we moved into an apartment with balcony, but the George Foreman electric grill is a great replacement — and costs less to buy and operate. (You can also use it indoors!) But I didn’t know until recently that there are some fine alternatives if you are willing to give up your gas fireplace.

As an active Realtor, I have seen and listed many homes with electric fireplaces. One of my recently sold listings, which you can still view at www.GreenMountainHome.info, has an electric fireplace sitting on the hearth of the wood-burning fireplace in the basement. Fast forward to 3:45 in that listing’s video tour to see it. The seller explained that the wood-burning fireplace would always overheat the basement, but the electric fireplace can be controlled with a thermostat.

Temperature control is just one of the challenges with wood-burning and most gas fireplaces. I mentioned others in the first paragraph above, but cost of operation is another one. Many people just want the ambiance of a burning fireplace, which you can get for pennies per hour from an electric fireplace, but most electric fireplaces also having heating modes, and if you want heat from it, the electric cost is still less than the cost of gas for an equivalent amount of heat generation.

Much of the heat generated by a gas (or wood) fireplace goes up the chimney, whereas electric fireplaces are unvented and therefore 100% efficient in that respect. No chimney also means no rodents or birds taking up residence in them.

At www.ElephantEnergy.com you’ll find a web page devoted to electric fireplaces, from which I downloaded the two pictures below. On that page they describe seven different types of electric fireplaces, two of which — an insert and wall-mounted — are shown here.

That web page addresses the following considerations: Lower costs; reduced carbon emissions; increased energy efficiency; improved safety; ambiance options; and model types.

In terms of costs, the web page claims a 30% savings over the cost of a gas fireplace. The electric fireplace generates less heat at lower cost, but when it’s used to supplement, not replace, your central heating or for ambiance, that should be fine. If your home is solar-powered, it can be free. You can’t create gas!

Model types which offer ambiance and/or heating options are broken down as follows:

Pre-fab fireplaces can be either free-standing or wall-mounted and can be plugged into any 120 Volt outlet. They range from $400 to $4,000 depending on the features you want.

Custom fireplaces require unique installation and can range in price from $2,000 to $10,000.

Wall-mounted fireplaces resemble flat-screen televisions and can cost as little as $300.

Electric fireplace inserts allow you to make attractive use of your existing fireplace hearth and firebox. According to the website, they range in price from $400 to $3,000.

Recessed electric fireplaces are nice if you’re willing to build out a wall to accommodate the unit’s depth, and can be quite attractive. The design options are limited only by your imagination. Cost can range from $400 to $7,000 or more.

Built-in electric fireplaces are just a variation on the above, but typically include a hearth, mantel and surround. Intended for heating, not just ambiance, they can range from $3,000 to over $10,000.

Water vapor electric fireplaces are my favorite. No one will mistake them for a gas or wood-burning fireplace, but they “spark” elegance and style. That’s the other example included above. They create 3-di-mensional “flames” through the use of water vapor and LED lights. Heating is not an option.

Elephant Energy does not sell fireplaces (or other systems), but they link to ModernBlaze.com, which sells a wide variety of all the types of fireplaces listed above. They offer free shipping and returns and a 10% discount if you sign up for text messages.

If You Want an Actual Flame, Ethanol Is a ‘Green’ Option

Last week I shot a narrated video tour of an all-electric home that will be in October 7’s Metro Denver Green Homes Tour. It’s Michele Merritt’s Lakewood home, and she has two fireplaces that burn liquid ethanol. (Fast forward to 2:33 in my video tour.)

Ethanol fireplaces are the easiest kind to install because they require no venting, construction or electrical outlet. You can build it into a wall, like a regular fireplace, but you can also have one as an indoor firepit (see picture below), since CO2 is the only fume. You pour the liquid ethanol (basically just alcohol) into the reservoir and light it. A one-liter bottle of ethanol will burn for several hours. ModernBlaze.com sells 6 bottles for $87 including shipping. They sell a 24-inch ethanol burner for $1,895.

Here’s a link to the full writeup on ModernBlaze.com about ethanol fireplaces (from which I downloaded the above picture).

.

In a July 27th article on realtor.com, the National Association of Realtors’ chief economist, Lawrence Yun, was quoted as saying, “The recovery has not taken place, but the housing recession is over. The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply.”

“The West—the country’s most expensive region—will see reduced prices, while the more affordable Midwest region is likely to see a small positive increase,” Yun was quoted as saying in the article.

Yun’s analysis was based on June statistics, but I can see some evidence of his statement in my own experience. My newest listing in Lakewood, featured last week for $700,000, went under contract in three days amid competing offers for $720,000, leading to cancelation of the open house scheduled for day 4.

Another listing, a $1,250,000 ranch in north Golden, also went under contract last week for just below its listing price.

The fact remains that the increase in mortgage interest rates has many sellers holding onto their current home even though they’d like to move. If you had a 2.9% mortgage on your current home, you’d want to stay put rather than give it up and buy a replacement home with a 7% mortgage, right? The industry refers to homeowners in that situation as “rate-locked.”

Builders of new homes are benefiting from the low inventory of existing homes for sale. The sale of new homes surged in May and declined in June, but the trend is still upward. Buyers like buying a new home because, in addition to being new, they can usually be purchased without a bidding war.

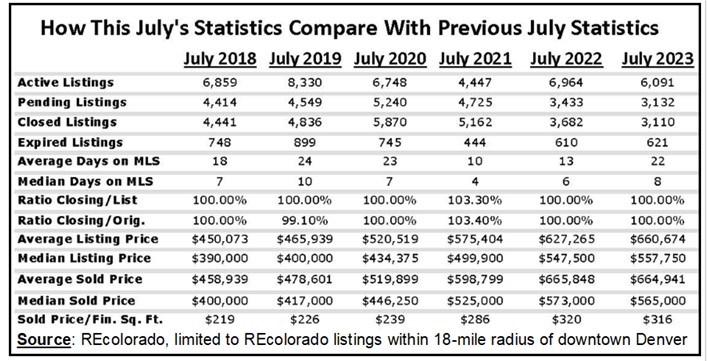

Yun, of course, is quoting national statistics, but you and I know that all real estate is local, so I created the chart below using the tools available to me on REcolorado, Denver’s MLS, looking only at listings within 18 miles of downtown Denver.

Current inventory compares favorably with previous years in that chart, although pending and closed sales are down significantly. Values are still high, with the price per finished square foot near last July’s high.

Forecasters, me included, were surprised at the strength of the current real estate market. We thought a true recession was in the cards, but in fact the market remains quite strong. I can only attribute the market’s performance to the large number of buyers still in the market and the continued low unemployment rate.

What will the market be like as we move into fall and winter? Stay tuned, because I don’t want to venture a guess!

One of the two value statements on our yard signs is “Promoting and Modeling Environmental Responsibility.” (See logo.) If you’re a buyer wanting to assess the sustainability of the homes you are considering, you owe it to yourself to hire one of our agents, because we know this topic better than most real estate agents.

In addition to our agents pointing out the good and bad points of the houses we show you, our inspectors “speak green” too, and, as a fall special, we are offering new clients a Free Energy Audit after closing. Call 303-525-1851 for details.

Prior to 1988, you had to reinvest the profits from selling your home into a new home, but that is no longer the case. As long as you have lived in your primary home for two of the last five years at the time of sale, you are exempt from taxation on your capital gain up to $250,000 (single) or $500,000 (married).

If your spouse dies, you can still get the $500,000 exemption if you sell less than two years after his or her death.

In calculating your capital gain, you take the price of the home when purchased plus any capital improvements (not repairs) made to the home plus the cost of selling (commissions, title insurance, etc.) and subtract that from your selling price. Note: this is my layman’s understanding. Always consult a qualified tax advisor to see how these rules apply in your situation.

Here is a lengthier explanation of the above rules plus some I didn’t mention — sorry I didn’t make note of the source:

The capital gains exclusion for selling one’s primary residence is a tax benefit in the United States that allows homeowners to exclude from their income a portion or all of the capital gain they realize from the sale of their main home, under certain conditions.

Remember that tax laws are complex and can change, and individual circumstances can have a significant impact on tax obligations. It’s important to consult with a tax advisor or accountant to understand the potential tax implications of a home sale.