In a July 27th article on realtor.com, the National Association of Realtors’ chief economist, Lawrence Yun, was quoted as saying, “The recovery has not taken place, but the housing recession is over. The presence of multiple offers implies that housing demand is not being satisfied due to lack of supply.”

“The West—the country’s most expensive region—will see reduced prices, while the more affordable Midwest region is likely to see a small positive increase,” Yun was quoted as saying in the article.

Yun’s analysis was based on June statistics, but I can see some evidence of his statement in my own experience. My newest listing in Lakewood, featured last week for $700,000, went under contract in three days amid competing offers for $720,000, leading to cancelation of the open house scheduled for day 4.

Another listing, a $1,250,000 ranch in north Golden, also went under contract last week for just below its listing price.

The fact remains that the increase in mortgage interest rates has many sellers holding onto their current home even though they’d like to move. If you had a 2.9% mortgage on your current home, you’d want to stay put rather than give it up and buy a replacement home with a 7% mortgage, right? The industry refers to homeowners in that situation as “rate-locked.”

Builders of new homes are benefiting from the low inventory of existing homes for sale. The sale of new homes surged in May and declined in June, but the trend is still upward. Buyers like buying a new home because, in addition to being new, they can usually be purchased without a bidding war.

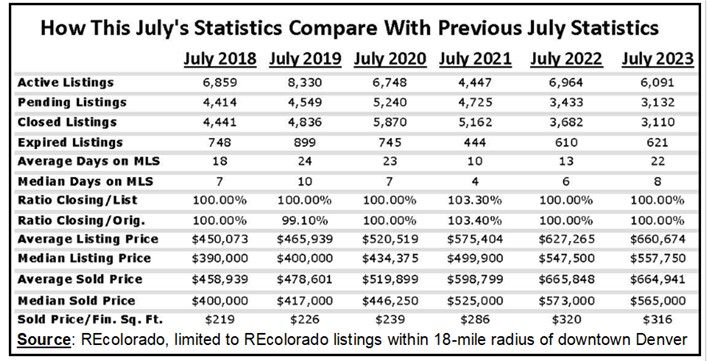

Yun, of course, is quoting national statistics, but you and I know that all real estate is local, so I created the chart below using the tools available to me on REcolorado, Denver’s MLS, looking only at listings within 18 miles of downtown Denver.

Current inventory compares favorably with previous years in that chart, although pending and closed sales are down significantly. Values are still high, with the price per finished square foot near last July’s high.

Forecasters, me included, were surprised at the strength of the current real estate market. We thought a true recession was in the cards, but in fact the market remains quite strong. I can only attribute the market’s performance to the large number of buyers still in the market and the continued low unemployment rate.

What will the market be like as we move into fall and winter? Stay tuned, because I don’t want to venture a guess!