Golden Real Estate is justly proud — if I say so myself — of having a Net Zero Energy office, meaning that our solar photovoltaic panels produce all the electricity needed to heat, cool and power our office as well as to the charge the five Teslas owned by our agents and me and offering free EV charging to the general public. (We have four EV charging stations at our office — two for our own use and two for the public.)

Meanwhile, Xcel Energy boasts that it is moving in the direction of 100% renewable energy and facilitating the adoption of electric vehicles. A big part of that is promoting “workplace charging.”

Xcel is right to promote workplace charging over, say, charging stations at retail stores, because cars are parked for up to 8 hours at one’s workplace — long enough to fully charge almost any EV using a standard Level 2 (240V) charging station.

So why is Xcel Energy penalizing small companies like Golden Real Estate which have already installed workplace charging stations for EVs?

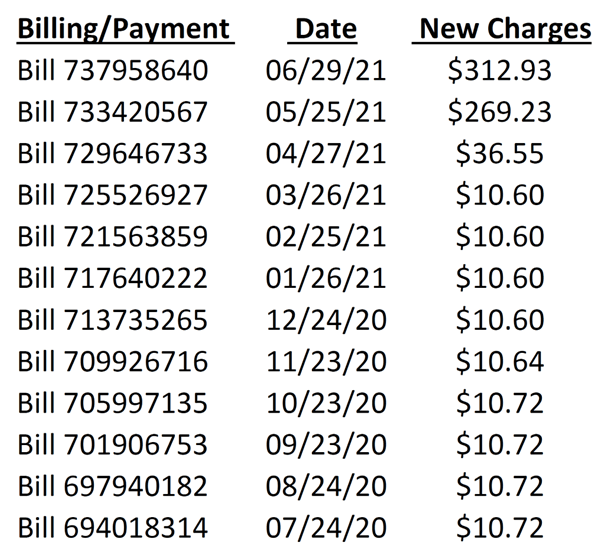

As stated above, we generate all the electricity needed at our office on South Golden Road. Until this March, our monthly Xcel bill was under $11 every month — the cost of being connected to Xcel’s electric grid.

But now our Xcel bill is over $300 per month, even though we are still generating all the electricity we use. How can that be? It’s because one day in March we drew over 30,000 watts of energy during a single 15-minute period, converting us automatically from standard “commercial” service to “demand” service. That means that in addition to the charges for electricity consumption, we are now charged for the highest amount of electricity that we draw during each month.

So our electric bill at Golden Real Estate is now over $300 per month regardless of the amount of actual electricity we consume during any particular month. To put it in numbers, we are charged about $15 per kilowatt for peak demand, and our monthly maximum draw of power is usually about 20 kilowatts. Thus, we are charged $300 each month even though our net consumption of electricity is zero!

The only way we could draw over 25 kW of electricity at a given time is because we are charging cars at all four charging stations, something Xcel says they want to encourage.

When I communicated my dilemma to Xcel Energy, the response was to tell me that they’re introducing a new EV charging tariff later this summer. Unfortunately, the tariff requires that Xcel install the charging stations and offers nothing to those of us who were early adopters and already have charging stations in place.

Under Xcel’s proposed EV tariff, my penalty would drop to a little over $100 per month. But that’s still a $100 penalty.

The logical solution would be for Xcel to modify its commercial tariff to make the demand threshold 50 or 75 kW instead of 25 kW for forcing small businesses like us into their demand tariffs.

Now some good news.

I made these same arguments during public comments at a May 13th virtual hearing before an administrative law judge (ALJ) adjudicating an Xcel Energy rate case. This Monday, that ALJ published his ruling and cited my own testimony in ordering Xcel to increase its demand threshold to 50 kW.

I had made the same argument a couple years ago during public comments at a regular PUC meeting, but I got no satisfaction at that time, so I wasn’t expecting to be more successful this time, but I was.

Ironically, I had already written this column with no clue that the ruling was about to be handed down. Indeed, this column was uploaded to three Jeffco weekly newspapers Monday morning without this news.

The ALJ’s ruling has a few more steps before it is finalized. Parties to the case can make final pleas and seek Commission reconsideration, akin to last ditch arguments, but I’m hopeful that my Xcel bill will return to $10.26/month soon.