Here are some ways I’ve been able to quantify what we are all seeing, namely the slowing of our local real estate market.

Looking within 14 miles of downtown Denver, the currently active (i.e., unsold) listings have a median days on MLS (DOM) of 27 days. However, the currently pending listings have a median DOM of 13, and the listings that closed in the last 30 days have a median days on the MLS of 7.

The listings that closed in the prior 30 days had a median DOM of just 5, which is what it has been, more or less, through the past couple years. So the market is definitely slowing, and slowing rather abruptly.

The number of active listings — what we refer to as “inventory” — has surged as homes sit on the market longer.

As I write this on Tuesday morning, there are 4,133 active listings on REcolorado, the Denver MLS, in that same 14-mile radius. That’s down from the peak of 5,521 at the end of July, but you have to go back to September 2020 to find a higher number of active listings than this July, as shown in the chart below.

In prior years, you’d see the number of active listings increase by 50%, more or less, from January to July, but look at this year’s more than triple surge from January to July in that chart.

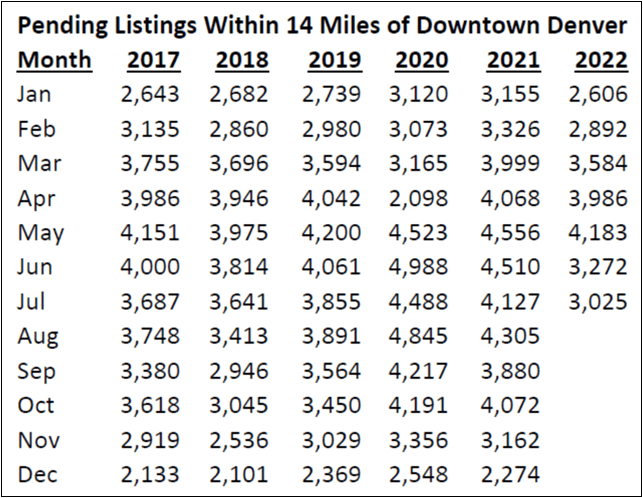

The chart of pending listings (below) is also instructive. Notice that in most months during 2021 and 2022, the number pending listings was almost always higher than the number of active listings (above chart), but that changed in June and July, when the numbers dropped dramatically.

You’d expect, in a normal market, with a lot more listings to choose from, that more listings would go under contract, but the reverse was true. As the number of listings surged in June and July, the number of listings going under contract went down substantially. That, too, reflects an abrupt slowing of Denver’s real estate market.

(As an aside, notice the effect of the pandemic on the April 2020 number of pending listings. April was the first full month of the pandemic, and the number of listings going under contract plummeted at a time of year when they would normally surge. Notice, however, the quick recovery in the following months. It has been surmised that Covid soon caused a surge in sales as people began to work at home and saw the need for more home office space and the opportunity to move further from their place of work since they were no longer commuting.)

Another statistic demonstrating the slowing of Denver’s real estate market is the extent to which the median sold price of homes has fallen as the market has turned.

The median sold price for that 14-mile radius peaked at $582,950 in June, but it fell to $550,000 in July and has fallen to $520,000 for closings during the first half of August — going down, but still higher than in any prior year.

NOTE: The above article was adapted for a Jefferson County audience using only Jeffco statistics. You can read a PDF of that version at www.JimSmithColumns.com.