By JIM SMITH, Realtor®

It was four years ago this month that Rita and I made a decision that has changed our lives for the better — we enrolled in a program called “8 Weeks to Wellness” at Body In Balance Wellness Center, located near our home in Golden.

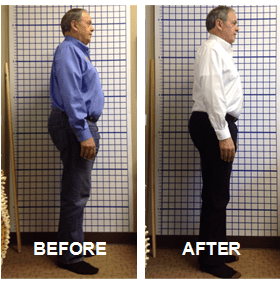

At the time, we were 68 years old and technically obese. I had a bit of a “beer belly” and weighed in the mid-240s. When the program ended in March 2016, I weighed under 220. At right are before and after pictures showing that much of my belly fat was gone. As I write this, I weigh 206, because I have continued with the lifestyle which I learned during the 8-week program.

What is that program? It’s a holistic program combining nutritional training, mindfulness, regular chiropractic adjustments and massages, and twice-weekly workouts with a trainer.

Since January is a time of year when we all think about shedding the weight we gained over the holidays and making other healthy resolutions, I thought it appropriate to share my personal story of making lifestyle changes that I know are leading to a longer, healthier life, and I invite you to learn about “8 Weeks to Wellness” and if it’s right for you — whether or not you’re a senior like us.

Let’s talk about nutrition first. Rita and I learned things we didn’t know from Drs. Leah and Scott Hahn during the program and at free lectures which they give each month.

Dr. Leah’s class on sugar was particularly enlightening. We learned how much sugar is in processed foods and how bad it is for us. Cancer feeds on sugar, and because so many foods contain sugar, Americans are consuming an average of 57 lbs. of added sugar per year. That’s eleven 5-lb. bags of sugar per person! Our bodies can only metabolize between 1/2 and 1/3 that much sugar, so the rest of it has to be stored as fat — belly fat.

The key, I learned from the doctors, is to learn where that “added” sugar is hidden. They taught us about the glycemic index, which ranks carbohydrates according to how they affect blood glucose levels. Carbohydrates with a high glycemic index (such as in many snacks, bread and potatoes) raise blood glucose levels too quickly. The body needs time to absorb the sugar created by carbs, so you want to choose foods with a low glycemic index such as green vegetables. Also, sugar is literally addictive, creating appetite rather than satisfying it. It’s true — you can’t eat just one potato chip!

We also learned about “good fats” and “bad fats.” Did you know that the low-fat movement created by the government had the unintended consequence of increasing our sugar intake? Since removing fat from foods makes them less tasty, food producers started adding sugar to low-fat products they sell us.

Obesity, we learned, is caused by all the excess sugar in our diets, and Type 2 diabetes is a natural biproduct of obesity caused by excess sugar intake.

So, in addition to reducing the granulated sugar we add to our foods, Rita and I have dramatically reduced our intake of added sugar by eliminating fast foods and soda beverages from our diet. We purchase only “real” foods, avoiding processed foods as much as possible, and we buy organic food, grass-fed beef and eggs from free-range chickens. (We shop at King Soopers, not at Whole Foods or Natural Grocers.)

It’s funny to think that we’re more concerned about the fuel we put in our cars than the fuel we put in our bodies. My handyman buys premium gasoline for his truck because he thinks it’s better for his engine, but you should see the food in his pantry!

Nutrition, however, is only one component of keeping our aging bodies healthy. We’ve all heard that we should exercise, but the doctors at Body in Balance have given Rita and me more context for its importance.

As we age, we all experience a loss of muscle mass. One evidence of muscle loss is the loose skin hanging from most old folks’ out-stretched biceps. That’s why I kept up my twice-weekly training sessions after the end of “8 Weeks to Wellness.” And it’s working.

I used to think that hiring a personal trainer was a waste of money, but I was wrong. My Monday afternoon and Friday morning sessions last one-hour under the guidance of a certified personal trainer who creates a “workout of the day” that works all the different muscle groups in my body in a manner that never gets tedious or repetitive. Through “bio-impedance analysis” I have seen the actual results of continuing this program — decreased fat and increased muscle mass in my body. Combined with my good nutrition and reduced weight, I will continue to age in good health and be less prone to falls and breaks. We should all strive for that as we age, and I urge you to consider the benefits.

Body In Balance Wellness Center, located in Golden, is a chiropractic office specializing in Network Spinal Analysis (NSA), which is more gentle than traditional chiropractic. In addition to their three chiropractors, they have two personal trainers in their fitness center, a functional medicine nutritionist, and two massage therapists on site. See www.BodyInBalanceChiropractic.com.

Because “8 Weeks to Wellness” made such a difference in Rita’s and my life, I encourage you to attend a free introduction to the program to be held at Body In Balance’s Golden facility, 755 Heritage Road, on Wednesday, January 22nd, at 6:15 p.m.

Call 303-215-0390 to reserve a seat. I’ll be there to share my story and answer questions.