Perhaps you’ve heard the expression, “A lawyer who represents himself has a fool for a client.” Most lawyers respect that truism, which is why you see lawyers hiring other lawyers when they are sued or criminally charged..

The same truism can be applied to real estate. Just this week I received a contract to buy one of my listings from a couple who are both real estate agents, but the offer was written by another agent. (I suspect he will share his 2.8% co-op commission with the buyers.)

There are also many buyers and sellers who aren’t agents but who are sufficiently experienced at buying and selling real estate to be considered “sophisticated” buyers or sellers. These persons may understandably think that they don’t need professional representation, saving themselves (if they’re selling) 3% or so on a listing commission. If they are buying without representation, they may think they can negotiate a lower purchase price by sparing the seller the 2.8% co-op commission typically paid to a buyer’s agent.

Let me debunk some misconceptions about each scenario separately — first for buyers.

Buyers typically pay nothing for professional representation, since buyers’ agents are universally compensated by the listing agent at a rate spelled out in the multi-list service (or “MLS”) to which all agents belong. Our Denver metro MLS is called REcolorado. Its website is www.REcolorado.com, which has both a consumer-facing and agent-facing side.

If you’re a buyer, you can go to that website and see all the listings which are currently available for purchase, and you can click on a link to email or call the agent for each listing. After that listing agent has determined that you don’t have an agency agreement with another agent, he or she will be delighted to help you buy his (or her) listing because he won’t have to give away half his commission to another agent. And he’ll probably ask you to hire him as a buyer’s agent if his own listing is not what you choose to buy, in which case he could earn 2.8% on that purchase.

If you, as a buyer, work with the listing agent, he or she will not, by law, be working in your best interest. At best, he’ll be a transaction broker, advising neither you nor his seller in the transaction. He won’t be able to advise you on the true value of the home or what you should offer, or how to respond to a counterproposal from the seller. He also won’t be able to advise you on inspection or other issues that arise during the transaction. You’re on your own — literally helpless.

Moreover, the chances are that you’re not saving the seller any money by being unrepresented, since the listing agent gets to keep the entire commission when he doesn’t have to share it with a buyer’s agent. My own research has shown that only 15% of listing agreements have a provision in which the commission is reduced if the agent doesn’t have to share his commission with a buyer’s agent. I know this to be true, because the MLS requires listing agents to disclose the existence of a “variable commission” in their listings. That’s one of the fields that is not displayed on the consumer-facing side of the MLS.

There are additional reasons why a buyer (in my opinion) should hire an agent instead of working directly with a listing agent — except when it’s a Golden Real Estate listing, as I’ll explain below. The most important reason is that a buyer’s agent, in addition to being your advocate in a transaction, has more access to information about listings than you have as a consumer.

For starters, agents have valuation software not available to consumers and can create a spreadsheet of comparable sales, so you’ll know whether a home’s listing price is reasonable. Zillow’s famed “zestimates,” by themselves, are not a dependable indicator of a property’s value.

Second, agents can do searches using any field on the MLS, not just the fields that are available to you as a consumer. Do you require a main-floor master? A second master suite? A fenced yard for your dog? An unfinished (or finished) basement? An agent can set up MLS searches on virtually any criterion that is important to you, and the system will notify you and your agent within 15 minutes of a new listing matching your specific search criteria.

As a buyer working with Golden Real Estate, you’ll enjoy added advantages to having representation, up to totally free moving using our own moving trucks, boxes and packing materials. With our focus on sustainability, one of my favorite closing gifts to buyers is a free energy audit of your new home — a $350 value. And if you have a home to sell, we reduce our commission on selling your current home. These benefits also apply when you’re buying one of our listings without your own agent. Call us for details.

Now let’s look at why sellers need to have professional representation.

Understandably, sellers have a huge incentive not to use an agent — they pay the commission for both agents in a transaction, which they assume (wrongly) is fixed at 6%. That would be a violation of federal antitrust laws. All commissions are negotiable. My personal rate is 5.6%, which I reduce to 4.6% if I don’t have to give 2.8% to a buyer’s agent. And I reduce those figures by another 1% if I earn a commission on the purchase of your replacement home. Because of federal laws against price fixing, I can’t dictate (or even discuss) what our other agents charge.

That’s still a lot of money, so you need to know what you’re getting for it.

At Golden Real Estate, sellers enjoy a free staging consultation, magazine quality still photos and professional quality narrated video tours which are posted on YouTube, the MLS, consumer real estate websites and on the custom website which we create for each listing. (Visit www.GRElistings.com to see the custom websites for our current active listings.)

We also provide free use of our moving trucks and moving boxes both to our sellers and to whoever buys our listings, even if their agent is with another brokerage. And, of course, all listings are featured in this column, which appears in eight editions of newspapers throughout both Denver and Jefferson counties.

We also have a proven track record of getting the highest possible prices for our sellers because of our skill at negotiating with buyers and their agents. Most agents will not reveal the offers they have in hand when they get multiple offers. We treat that situation like an auction, where everyone knows the highest current offer, and we regularly bid up the purchase price for our sellers — and the buyers and their agents appreciate not losing out in a blind bidding situation.

When a home is priced at or below its likely selling price based on recent sales of comparable homes, there’s a good chance in this seller’s market that multiple offers could bid it up, possibly above the value an appraiser might give it. So what happens then?

When a home is priced at or below its likely selling price based on recent sales of comparable homes, there’s a good chance in this seller’s market that multiple offers could bid it up, possibly above the value an appraiser might give it. So what happens then? Enjoy incredible mountain views from this special home at 17425 Rimrock Drive! Take advantage of the opportunity to own this 4-bedroom, 3-bathroom custom home. It backs to South Table Mountain open space, with unbeatable views of the foothills! It features an extra-tall garage — tall enough for your large truck —- with a mud room and laundry room on the main level. Look for more information in next week’s column. We have created a website for this home at

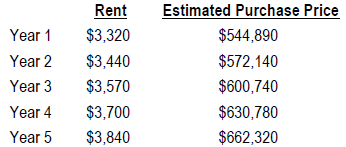

Enjoy incredible mountain views from this special home at 17425 Rimrock Drive! Take advantage of the opportunity to own this 4-bedroom, 3-bathroom custom home. It backs to South Table Mountain open space, with unbeatable views of the foothills! It features an extra-tall garage — tall enough for your large truck —- with a mud room and laundry room on the main level. Look for more information in next week’s column. We have created a website for this home at  As you might expect, these figures are subject to adjustment, since (1) the listed price may not be the final sale price, (2) the home may need renovation work, and (3) there may be other costs associated with purchasing and owning the property. These and other conditions are spelled out in the lease agreement that is signed by the prospective tenant.

As you might expect, these figures are subject to adjustment, since (1) the listed price may not be the final sale price, (2) the home may need renovation work, and (3) there may be other costs associated with purchasing and owning the property. These and other conditions are spelled out in the lease agreement that is signed by the prospective tenant. At right is how an MLS listing appears when displayed on the company’s website, showing the listing price on the right and the estimated initial rent on the left.

At right is how an MLS listing appears when displayed on the company’s website, showing the listing price on the right and the estimated initial rent on the left. thers, a transaction coordinator, a stager, a photographer, a drone pilot, several lenders, inspectors, and a handyman (who works only for our clients). That said, I don’t over-delegate. I like to get my hands dirty. I’ll put signs in the ground and do my own narrated video tours of each listing, including for my broker associates. Our office manager, Kim Taylor, helps with every aspect of listing and selling homes, but I’m happy to show listings, hold open houses, enter listings on the MLS, create websites for each listing, etc. I don’t just have a team, I’m part of the team.

thers, a transaction coordinator, a stager, a photographer, a drone pilot, several lenders, inspectors, and a handyman (who works only for our clients). That said, I don’t over-delegate. I like to get my hands dirty. I’ll put signs in the ground and do my own narrated video tours of each listing, including for my broker associates. Our office manager, Kim Taylor, helps with every aspect of listing and selling homes, but I’m happy to show listings, hold open houses, enter listings on the MLS, create websites for each listing, etc. I don’t just have a team, I’m part of the team. much goodwill for us among non-profits and community organizations, that I bought a second one last year. In 2008 I also invested in a storage shed for the moving boxes and packing materials that we provide free to clients.

much goodwill for us among non-profits and community organizations, that I bought a second one last year. In 2008 I also invested in a storage shed for the moving boxes and packing materials that we provide free to clients.