With the new year upon us, many of us are thinking about taxes. While it’s too late to strategize for 2018, let’s look at tax strategies going forward.

Owners of duplex, triplex and small multi-unit properties sell their properties for many reasons. Sometimes an owner wants to leverage equity into another property with better upside potential or a higher return on their investment or into multiple income producing properties.

Perhaps a duplex property was inherited but the responsibility of being a landlord has become overly burdensome. Whatever the situation, there are times when selling a multi-unit rental property and transferring the equity into an alternative “hands-off” type of investment makes sense. You can defer your capital gains tax obligations and keep your pre-tax capital growing for you by utilizing one of these IRS-approved options.

1031 Real Estate Exchange: The 1031 real estate exchange is a tax-deferral strategy that applies to investors who have sold or are about to sell investment real estate. This strategy allows a client to defer capital gains tax on all sales proceeds that are reinvested into other investment real estate properties, as long as the seller:

1) does not take “constructive receipt” of the funds within the exchange transaction. This means that the proceeds must go directly to a “qualified intermediary” and not at any point be in the seller’s own bank account.

2) meets all requirements outlined in the Internal Revenue Code.

721 Exchange: Less well-known than the 1031 exchange, the 721 exchange is another tax-deferral strategy which applies to investors who have sold or are about to sell investment real estate. This strategy is similar to the 1031 exchange but allows an investor to exchange his property for an interest in a diversified real estate portfolio known as a Real Estate Investment Trust (REIT). As with the 1031 exchange, the seller must not take constructive receipt of the sales proceeds within the transaction.

Delaware Statutory Trust is offered as replacement property for those seeking to defer capital gains taxes via a 1031 exchange. The DST allows for fractional interest ownership in various managed commercial properties with other investors, as individual owners within a Trust. Each owner receives a share of the cash flow income, tax benefits, and appreciation of an entire property. There is potential for annual appreciation and depreciation. Investments begin at $100,000 and allow investors to diversify into several properties.

Deferred Sales Trust is a tax-deferral strategy that applies to many different capital gains situations. These include the sale of a business, real estate, stocks, or bonds, as well as the maturity of principal on a note or carry-back, and even applies in certain debt forgiveness situations. The Deferred Sales Trust is different from the 1031 and 721 exchanges in that it does not require any reinvestment of the sales proceeds into real estate. It is similar to 1031 and 721 exchanges insofar as an investor cannot take constructive receipt of the funds within the transaction.

For expanded, detailed information on each of these tax strategies, visit www.DuplexAlerts.com and click on the “Sellers” tab in the main menu.

Always consult with your tax or wealth management professional when considering the sale or purchase of an investment property.

A quick caveat: Neither I nor any agent at Golden Real Estate is a CPA or tax advisor. Broker associate Andrew Lesko did the research for this article. Email Andrew at Andrew@GoldenRealEstate.com or 720-710-1000 with your questions or comments.

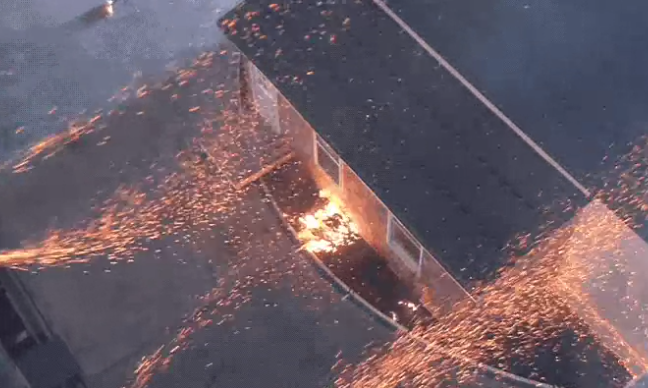

That subdivision, like the city of Paradise, California, is in what’s known as the Wildland Urban Interface, but the kind of winds we experienced as recently as last weekend can cause embers from a single house fire to spread quickly to other homes in urban areas, too. If embers start flying, you’ll want to make sure that your home is not ignited by them.

That subdivision, like the city of Paradise, California, is in what’s known as the Wildland Urban Interface, but the kind of winds we experienced as recently as last weekend can cause embers from a single house fire to spread quickly to other homes in urban areas, too. If embers start flying, you’ll want to make sure that your home is not ignited by them. The next time you have to replace your roof, consider what one of my clients in Golden did — install a stone-coated metal roof instead of yet another composition shingle roof. It will help to protect your home from fire, not just hail. At right is a picture of a stone-coated metal roof.

The next time you have to replace your roof, consider what one of my clients in Golden did — install a stone-coated metal roof instead of yet another composition shingle roof. It will help to protect your home from fire, not just hail. At right is a picture of a stone-coated metal roof. From that website and other research I’ve done, here are some thoughts about making homes more resilient in the face of wildfire.

From that website and other research I’ve done, here are some thoughts about making homes more resilient in the face of wildfire. Intense heat can cause windows to shatter, so consider using tempered glass all around, not just where required by code. Better yet, consider installing electric rolling metal shutters, which descend to completely cover exterior windows and doorways. One vendor’s website is

Intense heat can cause windows to shatter, so consider using tempered glass all around, not just where required by code. Better yet, consider installing electric rolling metal shutters, which descend to completely cover exterior windows and doorways. One vendor’s website is

I have known Jim Swanson since we both worked at Coldwell Banker in 2002. Jim, a lifelong resident of South Golden, followed me to RE/MAX Alliance where we both worked before I bought a former restaurant building on South Golden Road and created Golden Real Estate. I value his familiarity with and love of Golden. He’s also an excellent Realtor! You can reach him at 303-929-2727 or you can contact him by email at

I have known Jim Swanson since we both worked at Coldwell Banker in 2002. Jim, a lifelong resident of South Golden, followed me to RE/MAX Alliance where we both worked before I bought a former restaurant building on South Golden Road and created Golden Real Estate. I value his familiarity with and love of Golden. He’s also an excellent Realtor! You can reach him at 303-929-2727 or you can contact him by email at