As regular readers know, I’ve written several columns on technological developments in home construction and especially in the field of manufactured and modular home construction.

This week I was made aware of Liv-Connected, a 2018 startup which really got going during the pandemic when one of their partners, who was in the live event business building compact and readily deployed stage sets found himself with no work and turned his attention to compact and readily deployable modular housing.

At first, the company worked to improve upon the typical FEMA trailer being deployed to disaster areas, but then to the housing industry itself, beset as it was with labor shortages, supply-chain problems, and a soaring demand for second or remote homes.

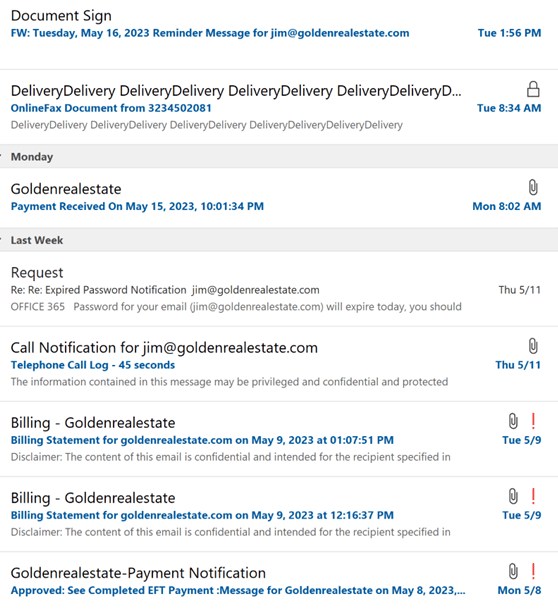

Manufacturing home components in a warehouse has inherent efficiencies, but the cost of delivery of the finished home and/or its components to the build site needs to be factored in. For homes to be installed on a foundation, transportation costs for most manufacturers are inflated by the need to use wide-load trucks and pilot cars and to pay the associated permit fees. Liv-Connected’s concept eliminates that need by breaking down the segments of the house and roof into components (see diagram below) that can be delivered on one standard semi trailer (also below) and linked together in one day at the build site.

The bathroom and kitchen modules are fully equipped at the factory with fixtures and appliances and can be mixed and matched to create the desired end result. Also, the modular design allows the addition of more bedrooms at a later date, as illustrated on the company’s website, www.liv-connected.com.

Part of Liv-Connected’s business is building tiny homes or Accessory Dwelling Units (ADUs) under the brand Via, for which delivery costs are less because the homes are on a trailer chassis. The buyer could take delivery of them at the company’s Pennsylvania factory. Here’s a screenshot from their website:

Click here to read the June 2022 article on Forbes.com about the modular home industry, comparing and contrasting Liv-Connect’s business strategy with that of other off-site housing manufacturers. Here’s a link for an informative 9-minute video by Kerry Tarnow, an independent YouTuber.

Off-site construction has multiple advantages, including all-weather and year-round construction, much reduced waste, and much improved insulation. There’s also less loss due to vandalism or theft from the build site.

On-site work is limited to building the foundation with its entry points for water, sewer and other utilities, pre-matched to the underside of the Liv-Connect modules. Those connections, when done right, consume only about four hours of the one-day installation process. The driver of the truck is a Liv-Connect employee who is part of the installation crew.

The prices for Via homes start under $100,000. The prices for the modular homes, under the brand Connexus, start at $150,000.