One of my favorite newsletter subscriptions is to “Big Pivots,” written and edited by Allen Best. The focus is on sustainability, especially as it relates to real estate and home construction. This week’s newsletter featured an article which I am reprinting with permission because it would be hard to improve upon it.

By ALLEN BEST

It took Rod Stambaugh a couple of years before his vision of high-performance housing on the northeastern edge of Pueblo had anything to show. Now he and his two partners have begun getting results. In recent weeks they’ve sold three homes for an average price of $780,000.

“It’s been a long road, but it’s getting easier,” says Stambaugh.

The company, Pure Zero Construction, has 14 of the single-family houses under construction with work underway on the first of 51 townhomes.

None of the homes will have natural gas or propane. The company has rights to build as many as 500 additional homes in North Vista Highlands.

“We will compete all day on the merits and benefits of high-performance, all-electric homes as compared to stick-built housing that uses natural gas,” says Stambaugh. “We will win that battle every time.”

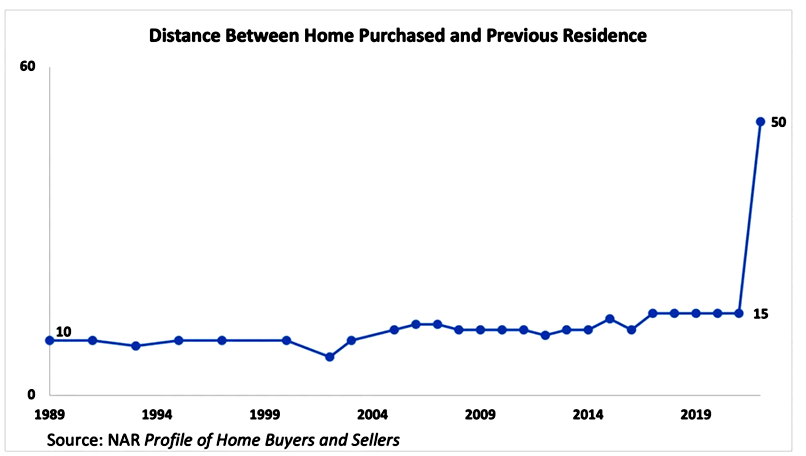

The townhomes will have 2,200 square feet and come in at around $600,000, he says. The company expects buyers to come from Denver and the northern Front Range.

Pueblo has a well-deserved reputation for lower real estate prices, but it does have pricier homes, too. Pure Zero is staking its reputation on both environmental performance, which translates into cost savings over time, and on health benefits.

Accumulating evidence points to harmful impacts of indoor air quality from natural gas combustion, whether for space and water heating or for cooking.

Gene Meyers, long-time “green” builder in the Denver metro area, has said that if for no other reason than health considerations, it’s time to get rid of natural gas in homes.

Having no natural gas comports with Colorado’s goals for greenhouse gas reduction goals. Several laws passed in 2021 provide direction for the decarbonizing of buildings through various new metrics, including building codes that make natural gas less desirable. So far, however, Colorado has not imposed bans on natural gas. The lone exception is Crested Butte, and the restriction there applies to relatively few units.

Stambaugh got into the building technologies world about eight years ago when he began building 189-sq.-ft. “tiny” homes after returning to Colorado from California. That business is called Sprout Tiny Homes. He sold some of the tiny homes to the Aspen Skiing Co. for use in Basalt. He is now at work on a third generation of workforce housing for Aspen.

Then, in 2020, he purchased land in Pueblo’s North Vista Highlands subdivision. He had thought that there would be no natural gas available in that subdivision. That turned out not to be true, but it’s true for the housing he and his two partners are building — and he has no plans to change.

“We will not deviate from our mission,” says Stambaugh. “We are going to build high-performance homes where you can see, feel and breathe the difference. That is our mission.”

One measure of a building’s performance is a metric called HERS, short for Home Energy Rating System. The lower the HERS score, the more energy efficient the home. Existing homes may have HERS ratings of 130. New homes built to code have HERS scores of 100 – al-though some production builders are shooting for lower scores. KB Home has said it plans to achieve HERS scores of 45 nationally by 2025.

How do Pure Zero’s homes rate? “We’re in the low 40s and we actually had a -9 score after adding solar,” says Stambaugh.

High-performance building has several components. One is building tightly to avoid loss of heat in the winter and cool air in the summer. Unlike houses built from 2x4s and 2x6s, the Pure Zero houses were built with structural insulated panels, or SIPs. They provide superior insulation and, says Stambaugh, provide corners that are always on the mark. They used to cost more than wood, but no longer.

Eliminating natural gas is another fundamental of the houses. Instead, electrically powered Mitsubishi air-source heat pumps extract the heat from outside air efficiently down to 0ºF (and with less efficiency below zero). They do the reverse during hot weather, eliminating the need for a separate air conditioning unit.

Stambaugh swears by Mitsubishi’s heat pumps. They cost $1,500 more than other air-source heat pumps, but their superior performance at lower temperatures will result in less need for backup heating. Those lower costs will recoup the original investment in five years.

[Golden Real Estate installed Mitsubishi heat pumps in its South Golden office and downtown storefront, and they work great.]

Instead of natural gas ranges, the houses in Pueblo have induction ranges. Bathrooms are tiled from top to bottom. Temperatures throughout the 3,900-square-foot houses (with fully finished basements) are consistent. They’re so structurally tight that they are quiet even within a construction zone.

There used to be a higher cost premium for the materials. That has somewhat gone away.

But building high-performance homes requires rethinking, including finding subcontractors willing to learn new techniques. Stambaugh says his team had difficulty at first finding craftsmen willing to learn how to install the new technology. Some refused. Now, as the housing construction industry has slowed, some of those workers have returned, looking for jobs.

You can subscribe to the Big Pivots newsletter (and find lots of other interesting articles) at www.BigPivots.com. You will learn a lot, as I have, from Allen’s articles.