The increasing prevalence of smart speakers like the Amazon Echo and security cameras inside and outside of homes, has introduced the possibility that sellers could be watching buyers and their agents and listening to what they say during showings.

The Colorado Real Estate Commission considers the privacy implications serious enough that this year’s annual update class for real estate brokers includes a section on legal jeopardy and practical advice.

Imagine, for example, that a buyer is overheard by a seller telling his/her broker, “I must have this home. I’ll pay whatever I have to!” The seller would immediately have an unfair negotiating advantage over the buyer.

The next time you are being shown a home, consider the very real possibility that the seller is parked nearby, watching and listening on his smartphone as you walk through the home, monitoring everything you and your agent say.

Although Colorado is a “one-party consent state,” meaning that only one party to a conversation needs to know it is being recorded, the implications of such technology are serious.

Given that people have rapidly embraced the use of internet-connected video and audio devices, enabling homeowners to monitor the goings-on in their homes, buyers and their agents would be well advised to minimize talk about the property and their level of interest during showings. Don’t count on being able to spot the devices.

Also, to avoid possible breach-of-privacy litigation, sellers should consider disabling such devices when putting their homes on the market or, at a minimum, placing a notice on the front door advising visitors of the presence of monitoring devices that might be active.

Rita and I have a Ring video doorbell on our house, and we love it. It rings on Rita’s cell phone, enabling her to see and speak with the visitor. Chances are, the person at the front door would think we are home, even if we are not, which is advantageous from a security standpoint. This feature accounts for the rapid adoption of Ring and other brands of internet-connected video doorbells and security cameras. Not everyone is a fan of these devices, as some believe that if your doorbell faces the street you could be violating the privacy of someone walking or driving beyond your front property line. (That was a point made during the annual update class which our agents took last month.)

In the update class our agents were advised both to warn buyers that sellers could be watching and listening, and to ask sellers during listing appointments whether they have video and audio recording devices in their home and, if so, to advise them of the implications of their use.

What are the legal arguments? A buyer’s lawyer would argue that a buyer, alone in an unoccupied house with his broker, has a “reasonable expectation of privacy.” A seller, on the other hand, can claim a legitimate interest in monitoring – and even recording — the activities and conversations of strangers in his home, as the possibility exists that someone could be casing the home for a subsequent burglary.

It’s likely that these arguments will play out in front of judges in the not-too-distant future, at which point we’ll have case law to guide us. Until then, both buyers and sellers should understand that the issue of privacy is real and that the use of eavesdropping equipment could put sellers in legal jeopardy.

When a home is priced at or below its likely selling price based on recent sales of comparable homes, there’s a good chance in this seller’s market that multiple offers could bid it up, possibly above the value an appraiser might give it. So what happens then?

When a home is priced at or below its likely selling price based on recent sales of comparable homes, there’s a good chance in this seller’s market that multiple offers could bid it up, possibly above the value an appraiser might give it. So what happens then? Enjoy incredible mountain views from this special home at 17425 Rimrock Drive! Take advantage of the opportunity to own this 4-bedroom, 3-bathroom custom home. It backs to South Table Mountain open space, with unbeatable views of the foothills! It features an extra-tall garage — tall enough for your large truck —- with a mud room and laundry room on the main level. Look for more information in next week’s column. We have created a website for this home at

Enjoy incredible mountain views from this special home at 17425 Rimrock Drive! Take advantage of the opportunity to own this 4-bedroom, 3-bathroom custom home. It backs to South Table Mountain open space, with unbeatable views of the foothills! It features an extra-tall garage — tall enough for your large truck —- with a mud room and laundry room on the main level. Look for more information in next week’s column. We have created a website for this home at  Last Saturday, the Lions Club of Golden dedicated to “All Golden Veterans” a gazebo it funded for the city’s Vanover Park. This is the 5th gazebo that the club has provided for city parks. Visit

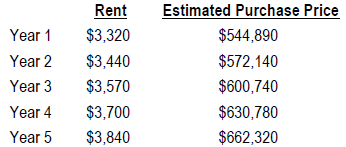

Last Saturday, the Lions Club of Golden dedicated to “All Golden Veterans” a gazebo it funded for the city’s Vanover Park. This is the 5th gazebo that the club has provided for city parks. Visit  As you might expect, these figures are subject to adjustment, since (1) the listed price may not be the final sale price, (2) the home may need renovation work, and (3) there may be other costs associated with purchasing and owning the property. These and other conditions are spelled out in the lease agreement that is signed by the prospective tenant.

As you might expect, these figures are subject to adjustment, since (1) the listed price may not be the final sale price, (2) the home may need renovation work, and (3) there may be other costs associated with purchasing and owning the property. These and other conditions are spelled out in the lease agreement that is signed by the prospective tenant. At right is how an MLS listing appears when displayed on the company’s website, showing the listing price on the right and the estimated initial rent on the left.

At right is how an MLS listing appears when displayed on the company’s website, showing the listing price on the right and the estimated initial rent on the left.