I’m not in the heating, ventilating and air conditioning (HVAC) business but I do have a pretty good understanding of the different methods of cooling a home, so I thought I’d review them this week. I welcome input from HVAC experts, so maybe I’ll have an update/correction for you next week.

I’m not in the heating, ventilating and air conditioning (HVAC) business but I do have a pretty good understanding of the different methods of cooling a home, so I thought I’d review them this week. I welcome input from HVAC experts, so maybe I’ll have an update/correction for you next week.

The most widely adopted method of cooling — what everyone calls “air conditioning” — involves a compressor-based system of refrigeration using the same technology as your kitchen refrigerator. A refrigerant (formerly Freon, before it was outlawed by the EPA) circulates within tubing from inside the home to outside and back again, absorbing and releasing heat in the process. Outdoors, the refrigerant cools and then re-enters the home, and the cycle repeats.

In a typical installation, the chiller (or “evaporator”) is positioned within a forced air furnace which functions as the air handler to move household air across the coils containing the refrigerant. As the refrigerant cools the air, it absorbs heat and then flows to the outdoor compressor where the refrigerant is forced back into its chilled state, releasing that heat to the outdoors. This is similar to your kitchen refrigerator, except that your refrigerator releases the heat into the kitchen (behind the refrigerator) instead of outdoors.

In homes without a forced air furnace, the A/C system requires its own air handler to take in air from the house, chill it, then distribute it, usually via its own ductwork. One such application would be a home with hot water heat and, thus, no ductwork that could be used for air conditioning. In such a home, the A/C compressor might be roof-mounted, with the air handler and ductwork located in the attic. Some ducts distribute the chilled air to one or more rooms, while other ductwork returns air to the air handler. The cooled air will naturally settle downward, cooling lower floor(s) without ductwork.

A/C compressors, however, require a lot of electricity, making this the most expensive method of cooling. In a dry climate like Colorado, an economical option is evaporative cooling. It requires no compressor, just a fan, a membrane through which to pass water and a water pump. You may know this as “swamp cooling.”

If you’ve noticed how even a slight breeze cools you off when you’re sweating you’ve experienced evaporative cooling. Water, it turns out, is a good refrigerant, absorbing heat as it evaporates, but it can only evaporate effectively when the humidity is low. That’s why you don’t hear of evaporative cooling being used in Houston, New York, or any other locale where high humidity makes it harder for air to absorb additional water through evaporation.

A swamp cooler, which is usually roof or window mounted, draws in hot outdoor air and passes it through a water-saturated membrane. It then directs that cooled air into the house. For a swamp cooler to be effective, one or more windows have to be opened a few inches to allow air to escape, because, unlike with a compressor-based air conditioner, the swamp cooler is pumping air into the house instead of recirculating air that is already in the house. If leaving windows open makes you feel insecure, there are ways to secure a window so that it is open the optimal four inches but can’t be opened any further.

On the negative side, an evaporative cooler requires more maintenance than standard A/C and uses lots of water. Those membranes absorb dirt and dust and need to be rinsed or replaced twice a season or more, which can be tricky when the unit is roof-mounted. Also, you have to winterize and de-winterize the outdoor units. On the positive side, it is healthier for you (and your wood furniture) to live with the 30% or higher humidity created through evaporative cooling than the 10% or lower humidity created by air conditioning.

A whole house fan is a great complement to either method of cooling. Before turning on the A/C or swamp cooler when returning to a very hot house, you can use a whole house fan to quickly flush that heat out of your house by leaving a lower door or window open and turning on the whole house fan located in your uppermost ceiling, such as a second floor hallway. You might also use the whole house fan (on a low setting) at night instead of air conditioning when the outside temperature is below, say, 65 degrees, leaving a window cracked to bring in that cool, fresh air.

A third method of cooling is the heat pump or mini-split system. We installed such a system at Golden Real Estate, which I described in detail in my January 4th column. You can find that column online at www.JimSmithColumns.com.

Mini-split systems combine the low maintenance of a compressor-based air conditioning system with the energy savings of a swamp cooler (but without the swamp cooler’s water consumption). Like A/C compressors, mini-splits have SEER ratings but, whereas high-efficiency A/C systems have SEER ratings under 20 at most, you can find mini-splits with SEER ratings of 30 or higher. And a mini-split also functions as a ductless heating system during cold weather.

It was a good day for Colorado’s 1.9 million HOA members on July 1, 2015, when all HOA managers were required to be fingerprinted, educated about their functions, and licensed by the Division of Real Estate.

It was a good day for Colorado’s 1.9 million HOA members on July 1, 2015, when all HOA managers were required to be fingerprinted, educated about their functions, and licensed by the Division of Real Estate. First, let’s distinguish between “driverless” and “self-driving” cars. My Tesla is self-driving when I employ its autopilot features, but I must keep my hands on the steering wheel. “Driverless” means there’s no driver — also called “autonomous” cars.

First, let’s distinguish between “driverless” and “self-driving” cars. My Tesla is self-driving when I employ its autopilot features, but I must keep my hands on the steering wheel. “Driverless” means there’s no driver — also called “autonomous” cars. I think it’s just fine that Tesla continues to improve the car’s driver assistance features, but I’m convinced that going full-driverless would be a big mistake. Accidents involving self-driving cars have recently made the news, although it has been reported that in each accident another, human-controlled car was at fault. In one video you can see a car careening diagonally towards you from across the highway.

I think it’s just fine that Tesla continues to improve the car’s driver assistance features, but I’m convinced that going full-driverless would be a big mistake. Accidents involving self-driving cars have recently made the news, although it has been reported that in each accident another, human-controlled car was at fault. In one video you can see a car careening diagonally towards you from across the highway. I’m not in the heating, ventilating and air conditioning (HVAC) business but I do have a pretty good understanding of the different methods of cooling a home, so I thought I’d review them this week. I welcome input from HVAC experts, so maybe I’ll have an update/correction for you next week.

I’m not in the heating, ventilating and air conditioning (HVAC) business but I do have a pretty good understanding of the different methods of cooling a home, so I thought I’d review them this week. I welcome input from HVAC experts, so maybe I’ll have an update/correction for you next week. Last Saturday, the Lions Club of Golden dedicated to “All Golden Veterans” a gazebo it funded for the city’s Vanover Park. This is the 5th gazebo that the club has provided for city parks. Visit

Last Saturday, the Lions Club of Golden dedicated to “All Golden Veterans” a gazebo it funded for the city’s Vanover Park. This is the 5th gazebo that the club has provided for city parks. Visit  It’s not uncommon for us to get a phone call or drop-in from someone who would like to buy but who might not be in a position do so at this time. They are looking for a rental, and for that we refer them to trusted companies that specialize in rentals. Sometimes the caller or visitor will inquire about rent-to-own, but we explain that it is nearly impossible to find a seller in this market who would consider rent-to-own when they can sell now for top dollar.

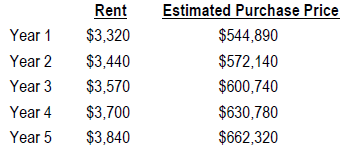

It’s not uncommon for us to get a phone call or drop-in from someone who would like to buy but who might not be in a position do so at this time. They are looking for a rental, and for that we refer them to trusted companies that specialize in rentals. Sometimes the caller or visitor will inquire about rent-to-own, but we explain that it is nearly impossible to find a seller in this market who would consider rent-to-own when they can sell now for top dollar. As you might expect, these figures are subject to adjustment, since (1) the listed price may not be the final sale price, (2) the home may need renovation work, and (3) there may be other costs associated with purchasing and owning the property. These and other conditions are spelled out in the lease agreement that is signed by the prospective tenant.

As you might expect, these figures are subject to adjustment, since (1) the listed price may not be the final sale price, (2) the home may need renovation work, and (3) there may be other costs associated with purchasing and owning the property. These and other conditions are spelled out in the lease agreement that is signed by the prospective tenant. At right is how an MLS listing appears when displayed on the company’s website, showing the listing price on the right and the estimated initial rent on the left.

At right is how an MLS listing appears when displayed on the company’s website, showing the listing price on the right and the estimated initial rent on the left. This Sunday, April 22nd, is the 48th anniversary of Earth Day. Here are some of the ways you can participate in this annual event and do your part in preserving this planet for future generations.

This Sunday, April 22nd, is the 48th anniversary of Earth Day. Here are some of the ways you can participate in this annual event and do your part in preserving this planet for future generations.