As homeowners 65 and over well know, they get a discount on their home’s property taxes once they have lived in their home for at least 10 years. It’s called the “senior property tax exemption.” For those who qualify, 50% of the first $200,000 in actual value of their primary residence is exempted from property taxation. At 100 mills, that’s worth $720. Rita and I have been in our current house for six years, so we can look forward to saving about that much on our property taxes if we stay put for another 4 years – and if the state legislature continues to fund it, as I’ll explain below.

As homeowners 65 and over well know, they get a discount on their home’s property taxes once they have lived in their home for at least 10 years. It’s called the “senior property tax exemption.” For those who qualify, 50% of the first $200,000 in actual value of their primary residence is exempted from property taxation. At 100 mills, that’s worth $720. Rita and I have been in our current house for six years, so we can look forward to saving about that much on our property taxes if we stay put for another 4 years – and if the state legislature continues to fund it, as I’ll explain below.

A veteran who has been deemed permanently disabled by the VA enjoys that same discount, but isn’t subject to that 10-year rule. He/she only has to have owned and lived in the house on Jan. 1st of the tax year. There is also a little-known program by which qualified seniors and veterans can defer the payment of property taxes. Under that program, the state of Colorado pays your local property taxes, creating a lien against your home for the deferred amount, which is paid off like any lien when the house is eventually sold. Conditions apply, of course, which you can read by Googling “Colorado senior property tax exemption,” as I did.

What you may not know is that any buyer, irrespective of age, enjoys that same property tax exemption for their first calendar year in a home they purchase from a senior citizen who earned that discount.

My new listing (below) brought this topic to mind. The sellers, who are over 65, paid only $1,221 in property tax last year, and the property tax bill will probably be the same for this year’s property taxes, which are payable in April 2019. Whoever buys the home in the next month or so will enjoy that senior property tax exemption next April and won’t begin paying the full property tax amount until 2020. The reason for this mini-windfall is that state law specifies that the exemption only requires that an eligible senior owned and lived in the house on Jan. 1st of the tax year.

Something else you may not know is that this property tax exemption does not cost the county or other local tax jurisdictions a penny. The state reimburses the jurisdictions for the discount given to qualified seniors. After making their annual revenue and expense estimates, the state legislature determines how much of a discount qualified seniors will earn. It wasn’t funded in 2009, 2010 and 2011, but it was restored in 2012 and remains in effect. Because the state’s balance sheet is expected to look good for the coming year, there’s certainly reason for optimism.

My only complaint with the senior property tax exemption is that it requires 10 years’ ownership of a home before seniors quality. This poses a disincentive to downsizing, which often makes sense for seniors, especially after one of them has died.

Last week I got a call from a reader who sold a house with structural defects last year, defects he had properly disclosed. He was concerned because he thought the current seller might not be disclosing those same defects to prospective buyers. He feared that the seller had simply covered up the defects when he finished the basement, hiding them from unsuspecting buyers.

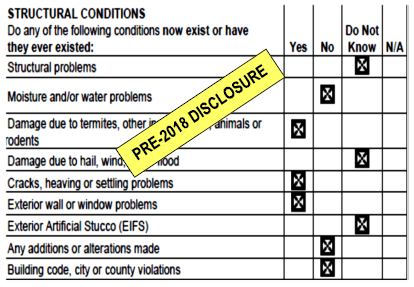

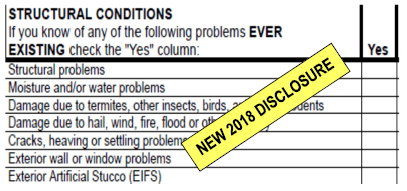

Last week I got a call from a reader who sold a house with structural defects last year, defects he had properly disclosed. He was concerned because he thought the current seller might not be disclosing those same defects to prospective buyers. He feared that the seller had simply covered up the defects when he finished the basement, hiding them from unsuspecting buyers. Prior to January 1st, the Sellers Property Disclosure asked sellers to answer “Yes,” “No,” “Do Not Know” or “N/A” to each item, as shown on the disclosure at right from one of my own transactions.

Prior to January 1st, the Sellers Property Disclosure asked sellers to answer “Yes,” “No,” “Do Not Know” or “N/A” to each item, as shown on the disclosure at right from one of my own transactions. What was nice about the previous version was that it required an answer to every item, even if that answer was “do not know” or “not applicable.” I’m not a lawyer, but it seems to me that if there were to be a civil trial over a failure to disclose a known defect, it would be more convincing to show that the seller answered incorrectly rather than simply remained silent on the issue at hand.

What was nice about the previous version was that it required an answer to every item, even if that answer was “do not know” or “not applicable.” I’m not a lawyer, but it seems to me that if there were to be a civil trial over a failure to disclose a known defect, it would be more convincing to show that the seller answered incorrectly rather than simply remained silent on the issue at hand. Conventional wisdom suggests that the low inventory of homes for sale is due to homeowners not putting their homes on the market. For months I’ve been pointing out that this is not true, and the chart at right proves my point. In creating it, I excluded all sales by builders, banks, corporations trusts, and government—all sellers except individuals. To the extent that an increasing number of individuals have their homes in the name of a trust or corporation, the numbers are understated.

Conventional wisdom suggests that the low inventory of homes for sale is due to homeowners not putting their homes on the market. For months I’ve been pointing out that this is not true, and the chart at right proves my point. In creating it, I excluded all sales by builders, banks, corporations trusts, and government—all sellers except individuals. To the extent that an increasing number of individuals have their homes in the name of a trust or corporation, the numbers are understated. Going on three years now, the current seller’s market has allowed agents to hone their bidding war skills – something the agents at Golden Real Estate have come to do quite well. In this week’s column, I’ll share some of ways we find success for buyers in this challenging market.

Going on three years now, the current seller’s market has allowed agents to hone their bidding war skills – something the agents at Golden Real Estate have come to do quite well. In this week’s column, I’ll share some of ways we find success for buyers in this challenging market. As I have written in previous columns, our limited inventory of active listings is due in part to sales that occur without the home being listed as “active” on the MLS. This can be frustrating to buyers waiting for a house they like to come on the market, only to learn that it was sold off-market. Given the chance, some of those frustrated buyers might have paid more than the selling price, in which case both those buyers and the seller have been harmed.

As I have written in previous columns, our limited inventory of active listings is due in part to sales that occur without the home being listed as “active” on the MLS. This can be frustrating to buyers waiting for a house they like to come on the market, only to learn that it was sold off-market. Given the chance, some of those frustrated buyers might have paid more than the selling price, in which case both those buyers and the seller have been harmed. When purchasing a home with a mortgage, one of the major hurdles for buyers in getting to the closing table concerns the home appraisal. The lender hires the appraiser – at the buyer’s expense – to make sure that the home is worth what the buyer has agreed to pay for it.

When purchasing a home with a mortgage, one of the major hurdles for buyers in getting to the closing table concerns the home appraisal. The lender hires the appraiser – at the buyer’s expense – to make sure that the home is worth what the buyer has agreed to pay for it. Even a fraction of a percentage point rise quickly adds up. According to realtor.com, on a $300,000 purchase with a 30-year fixed-rate mortgage and a 20% down payment, the difference between 4% and 5% is $142 a month. That’s more than $51,000 over the life of the mortgage.

Even a fraction of a percentage point rise quickly adds up. According to realtor.com, on a $300,000 purchase with a 30-year fixed-rate mortgage and a 20% down payment, the difference between 4% and 5% is $142 a month. That’s more than $51,000 over the life of the mortgage. Our drone pilot has moved to the Western Slope and is not always available when we need her. If you’re a licensed drone pilot (or want to be), give us a call. We have a state-of-the-art Mavic drone which we could make available to you for your own work in return for a discount on shooting aerial footage for our listings.

Our drone pilot has moved to the Western Slope and is not always available when we need her. If you’re a licensed drone pilot (or want to be), give us a call. We have a state-of-the-art Mavic drone which we could make available to you for your own work in return for a discount on shooting aerial footage for our listings.