It was reported last Wednesday that the 11-county Denver metro area real estate market had cooled dramatically in September. However, my research of the 5-county metro area on REcolorado.com (Den-ver’s MLS) did not confirm that.

It was reported last Wednesday that the 11-county Denver metro area real estate market had cooled dramatically in September. However, my research of the 5-county metro area on REcolorado.com (Den-ver’s MLS) did not confirm that.

The article, which was based on a market trends report from the local Realtor association, reported that the high-end market had experienced the largest decline, yet I found the opposite to be the case.

Comparing this September to September 2017, sales of homes over $500,000 increased slightly from 989 to 993 in the 5-county metro area. The number of active listings in that price range at the end of September was up 5% from September 2017, at 3,605 vs. 3,434.

The article reported that the number of homes that sold for over $1 million plummeted by 44.4% in September vs. August, but my research indicated that the number of sales was nearly identical to that of September 2017 — 104 vs. 105 sales. The number of active listings was also nearly identical to Sept. 2017 — 860 this year vs. 870 last year. I computed the decline in million-dollar home sales from August of this year at 37.8% for the 5-county metro area. Last year the August-to-September drop was 14%.

The fact is that the summer months this year were significantly hotter than last year, with July and August sales up more than 30% from last year. I would suggest that what we saw in September was really a return to the levels of last year, not a sign that the seller’s market has ended.

In the sub-$500,000 metro market, we did see a 20.6% decline in sales, from 3,516 in Sept. 2017 to 2,793 this year. Active listings at the end of September were up 12% from 2017, giving buyers more listings from which to choose.

In the 5-county metro area, the median sold price for detached single family homes hit a high of $450,000 in April then declined over the summer to $425,000 in September. This might sound troubling until you realize that, even with the summer slow-down, this represents a 5% increase over September 2017, which also had lower numbers than every month since March 2017.

The median days on market this September for the sub-$500,000 sales was 13, compared to 11 days in September 2017.

Metro area homes priced over $500,000 sold more quickly and for more money than in September 2017 — 19 days vs. 24 days on market, with an increase in median sold price to $630,000 from $618,500 a year ago.

Unlike the single-family homes, condos and townhomes took a little longer to sell this September — 11 days vs. only 7 last year — but the median sales price jumped by 14.7%, from $260,760 to $299,000. This also represented an increase of 2.7% over August 2018.

In conclusion, although our seller’s market may be getting old, reports of its demise are, shall we say, exaggerated.

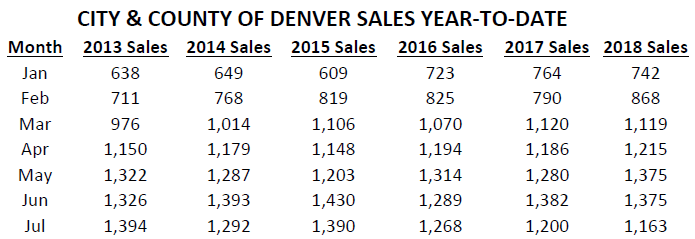

Now let’s look at Denver statistics

Since “all real estate is local,” I studied the active, under contract and sold statistics for five Denver neighborhoods which I chose for their diversity. At right are two charts, one for last month and the other for September 2017.

Since “all real estate is local,” I studied the active, under contract and sold statistics for five Denver neighborhoods which I chose for their diversity. At right are two charts, one for last month and the other for September 2017.

Comparing this September’s statistics to those of September 2017, the only neighborhood showing much softening is Barnum, whose huge run-up in values in recent years may have run its course.

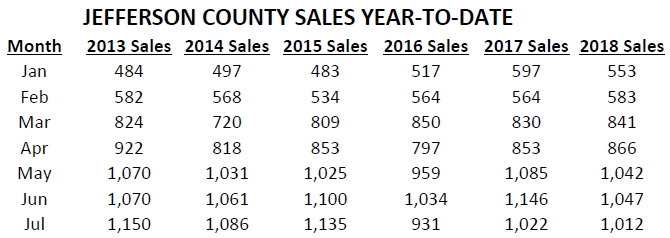

Now let’s look at Jefferson County.

I also studied the active, under contract and sold statistics for various Jefferson County addresses. At left are the same two charts, one for last month and the other for September 2017.

I also studied the active, under contract and sold statistics for various Jefferson County addresses. At left are the same two charts, one for last month and the other for September 2017.

The most significant change you’ll notice in comparing the two months is that there are notably fewer listings under contract this September compared to September 2017, as well as a decrease in active and sold listings:

Last week I documented how our real estate market is showing signs of slowing. In that column I noted an increase in the number of price reductions for metro area listings and compared statistics from this summer with those from last summer, showing how the ratio of sold price to original listing price and the median days on market suggest a slowing in our real estate market.

Last week I documented how our real estate market is showing signs of slowing. In that column I noted an increase in the number of price reductions for metro area listings and compared statistics from this summer with those from last summer, showing how the ratio of sold price to original listing price and the median days on market suggest a slowing in our real estate market.

Selling your home is no small matter, and small mistakes can lead to big losses. So who can you trust to do right by you or to give you sound advice? That’s what prompted me to start writing this column over a decade ago and why I archive all my columns going back several years at

Selling your home is no small matter, and small mistakes can lead to big losses. So who can you trust to do right by you or to give you sound advice? That’s what prompted me to start writing this column over a decade ago and why I archive all my columns going back several years at  We had a great turnout of EVs and people interested in buying an EV at our event last Saturday. A special treat was the participation of four owners who brought their new Tesla Model 3s, three of which are shown in this picture. The one on the left had only 26 miles on the odometer, because the owner drove it straight from taking delivery of it that morning! During the event we received notification that lifetime free supercharging with a referral code for certain Tesla models is being discontinued after Sept. 16th — next Sunday! If you want to take advantage of that offer, you can use my own referral code, by going to this website URL:

We had a great turnout of EVs and people interested in buying an EV at our event last Saturday. A special treat was the participation of four owners who brought their new Tesla Model 3s, three of which are shown in this picture. The one on the left had only 26 miles on the odometer, because the owner drove it straight from taking delivery of it that morning! During the event we received notification that lifetime free supercharging with a referral code for certain Tesla models is being discontinued after Sept. 16th — next Sunday! If you want to take advantage of that offer, you can use my own referral code, by going to this website URL:  ough the often dreaded Homeowners Association (or “HOA”) has been around for a long time, its widespread use goes back only a few decades. Prior to, say, 1980, it was common for new subdivisions to have covenants, but no reasonable way to enforce them. This begs the question; “why have covenants if they can’t be enforced?” Enter the HOA, an entity designed and created to answer that question.

ough the often dreaded Homeowners Association (or “HOA”) has been around for a long time, its widespread use goes back only a few decades. Prior to, say, 1980, it was common for new subdivisions to have covenants, but no reasonable way to enforce them. This begs the question; “why have covenants if they can’t be enforced?” Enter the HOA, an entity designed and created to answer that question. By now it should be clear to you — as it is clear to the automotive industry — that electric vehicles are neither a passing fad nor something that only the wealthy can afford.

By now it should be clear to you — as it is clear to the automotive industry — that electric vehicles are neither a passing fad nor something that only the wealthy can afford. Drive Electric Week, presented by Plug-In America, the Sierra Club, and the Electric Auto Association, is your opportunity to meet and talk with current owners (not dealers) of electric cars, get your questions answered, and even take a ride in one or more models.

Drive Electric Week, presented by Plug-In America, the Sierra Club, and the Electric Auto Association, is your opportunity to meet and talk with current owners (not dealers) of electric cars, get your questions answered, and even take a ride in one or more models. When I was a new agent at Coldwell Banker, my trainer shared the expression “listors last.” In other words, our goal should be to succeed as a listing agent, even if we get our first paychecks by representing buyers. But how does one get listings? You can solicit your “sphere of influence” (i.e., friends and family), but that can take you only so far. You can hold open the listings of busier, established agents who either can’t or don’t want to hold their own listings open, hoping that an unrepresented buyer comes along who also needs to sell their home but hasn’t yet hired a listing agent.

When I was a new agent at Coldwell Banker, my trainer shared the expression “listors last.” In other words, our goal should be to succeed as a listing agent, even if we get our first paychecks by representing buyers. But how does one get listings? You can solicit your “sphere of influence” (i.e., friends and family), but that can take you only so far. You can hold open the listings of busier, established agents who either can’t or don’t want to hold their own listings open, hoping that an unrepresented buyer comes along who also needs to sell their home but hasn’t yet hired a listing agent.